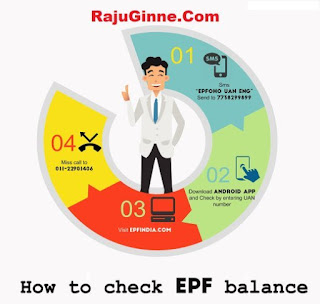

Epfo Balanace

find all EPFO services and online facilities for EPFO employees and

employers. The latest news about epfo Scheme, employee provident fund

scheme India eligibility interest rates etc.

Origin of Employee provident fund Organization EPFO

government of India decided to provide Assistance to the workers or employees in unemployment, illness, Disability and Old age. This is the main reasons to bringing the employee provident fund organization 1952 act.

Total EPFO Funds as on March 31/2016 8.6 lakh crores. in USD $130 Billion. Now employee provident fund organization have decided invest in stock market about 15%. Now employee provident fund organization announced investment 2,800 crores in Central Public Sector Enterprises exchange-traded fund (CPSE-ETF).

employee provident fund organization Schemes:

EPFO Withdrawal forms:

Form 19 for PF Transfer /withdrawal

FORM 10 C for pensions withdraw

EPFO Services For employees

Almost all employer activities related to EPFO done by online. employee provident fund organization Launched new UAN employer portal for establishments to make their regular activities like following below.

New Members registration or pf account generation, Establishment registration with employee provident fund organization (digital signatures are compulsory), EPF payment, UAN Login creation for members, Approving PF transfer and withdrawal made by the employee either offline or online at member claims portal etc.

Registering an Establishment with EPFO

Now employers can register with EFPO on OLRE portal (Online register establishments). PF Codes for establishment allocated online. for any queries regarding employer issues a toll-free number available on EPF portal 1800 118 005 but this works only on working days between 9AM-5PM. Digital certificates and PAN Number of employer required for EPF Registration.

Employers are fall under 3 categories according to the EPF act 1952. Employers who already have pf code, Employers comes under the provision of act 1952. Some employers don’t fall in the epfo act but they volunteered to join epfo.

EPF Payment by Employer: EPF India using SBI EPF payment service for employer contributions every month. if you don’t know exactly how to make EPF payment let check it on epf payment page. Employers can pay debit/ credit card any national bank in India.

EPFO UAN Services

UAN Number launched by PM Modi on 2014 October. UAN Number acts as the umbrella for employees. with help of UAN, We can withdraw money online. No transfer requested because it automatically transferred. employees can manage multiple pf accounts with one UAN number.

employee provident fund organization Regional websites & Offices

Employee enrollment campaign starts from January 1st, 2017 to March 31st, 2017. This scheme encourages employees who were entitled to membership between 2009 to 2016. but not joined till enrolled with employee provident fund organization.

About EPFO Employees’ Provident Fund Organisation

EPFO Formed by the act of 1952 It’s run maintained by CBT central

board of trustees.employee provident fund organization Comes under

Ministry of labor and employment. EPF ordinance passed in 1951, formed

by employee provident fund provisions act 1952. EPF scheme not

applicable for J&K.Origin of Employee provident fund Organization EPFO

government of India decided to provide Assistance to the workers or employees in unemployment, illness, Disability and Old age. This is the main reasons to bringing the employee provident fund organization 1952 act.

EPF Organization Authorities hierarchy level

EPF offices located in every state and regional sub-office located in every city town in India. EPFO head office established in Delhi.Additional Central Provident Fund Commissioner takes care about One state employee provident fund organization offices related issues & workflow. Regional offices handled by Regional Provident Fund Commissioners (RPFC) Grade I, Sub-regional offices by Regional Provident Fund Commissioners (RPFC) Grade III. All above officers assisted by Assistant Provident Fund Commissioners and another field officer works with the Local establishment and local EPF offices called as Enforcement Officer.Total EPFO Funds as on March 31/2016 8.6 lakh crores. in USD $130 Billion. Now employee provident fund organization have decided invest in stock market about 15%. Now employee provident fund organization announced investment 2,800 crores in Central Public Sector Enterprises exchange-traded fund (CPSE-ETF).

employee provident fund organization Schemes:

- EPF Employee provident fund scheme,

- EPS employee pension scheme,

- EDLI: Employee deposit linked insurance scheme.

EPFO Withdrawal forms:

Form 19 for PF Transfer /withdrawal

FORM 10 C for pensions withdraw

EPFO Services For employees

employers Role in EPFO

According to the employee provident fund organization 1952 act, the establishment which has more than 20 or employees have to contribute in EPF scheme.Almost all employer activities related to EPFO done by online. employee provident fund organization Launched new UAN employer portal for establishments to make their regular activities like following below.

New Members registration or pf account generation, Establishment registration with employee provident fund organization (digital signatures are compulsory), EPF payment, UAN Login creation for members, Approving PF transfer and withdrawal made by the employee either offline or online at member claims portal etc.

Registering an Establishment with EPFO

Now employers can register with EFPO on OLRE portal (Online register establishments). PF Codes for establishment allocated online. for any queries regarding employer issues a toll-free number available on EPF portal 1800 118 005 but this works only on working days between 9AM-5PM. Digital certificates and PAN Number of employer required for EPF Registration.

Employers are fall under 3 categories according to the EPF act 1952. Employers who already have pf code, Employers comes under the provision of act 1952. Some employers don’t fall in the epfo act but they volunteered to join epfo.

UAN Portal Services for Employers

Employers can access all the UAN Members details on EPF portal. But employers have to sign in with the required credentials like establishment code, extension and the mobile which is registered on ECR 2.0 Portal. Then verify mobile by OTP to access the UAN member details online.EPF Payment by Employer: EPF India using SBI EPF payment service for employer contributions every month. if you don’t know exactly how to make EPF payment let check it on epf payment page. Employers can pay debit/ credit card any national bank in India.

EPFO UAN Services

UAN Number launched by PM Modi on 2014 October. UAN Number acts as the umbrella for employees. with help of UAN, We can withdraw money online. No transfer requested because it automatically transferred. employees can manage multiple pf accounts with one UAN number.

employee provident fund organization Regional websites & Offices

EPFO Login Portals list for services

- UAN Unified employer portal https unified portal EPF India gov in

- EPFO Unified portal list

- https://unifiedportal-emp.epfindia.gov.in

- ecr portal

- Employer esewa portal https://esewa.epfoservices.in/

- employee provident fund organization OTCP Online Transfer claim portal http://memberclaims.epfoservices.in

- EPF employee login portal: members.epfoservices.in or uan member portal.

- UAN members login portal https://uanmembers.epfoservices.in/

- employee provident fund organization employer login portal https://esewa.epfoservices.in/

- online payment website www.epfindia.com/site_en/Online_ECR.php

- Payment at SBI Portal https://www.onlinesbi.com/prelogin/epfoinputdisplay.htm

- EPF balance checking link with pf number http://www.epfindia.com/site_en/KYEPFB.php

- epf claim status with pf number http://www.epfindia.gov.in/site_en/KYCS.php

EPF Withdrawal rules

- The Employee can only withdrawal full amount if he crossed 58 years.

- Employee can withdrawal without employer consent by attaching gazetted office sign

Employee enrollment campaign starts from January 1st, 2017 to March 31st, 2017. This scheme encourages employees who were entitled to membership between 2009 to 2016. but not joined till enrolled with employee provident fund organization.

Comments

Post a Comment